David Cameron got caught up in the lobbyist scandal

A flurry of text messages, emails and phone calls. Between March 5 and June 26, 2020, David Cameron lobbied extensively with his former colleagues in the British government and top management. Altogether, the former British prime minister has contacted the country’s highest representatives on fifty-six occasions, from the Secretary of the Treasury to second-ranked in the Bank of England, including ministers and senior officials. The goal: to change the rules for emergency loans granted by the state during the pandemic, in favor of Greensill Capital, the company he worked for. For which he received a salary ‘Much higher’By his own admission, what he got as prime minister was around 180,000 euros a year.

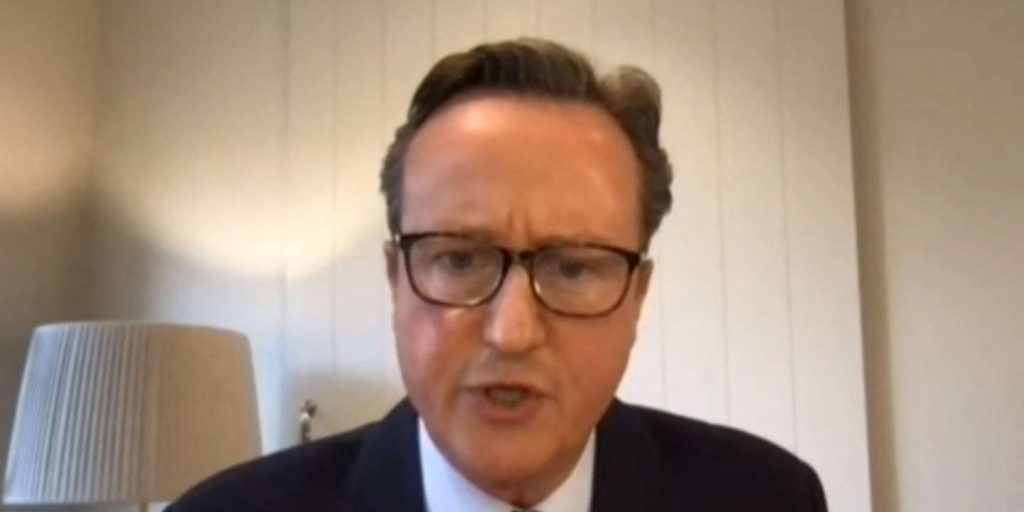

Mr Cameron has been summoned Thursday May 13th before a parliamentary committee to explain himself on the issue with extreme caution since leaving Downing Street in June 2016 the day after the Brexit victory. For two hours, by videoconferencing, his financial motives, lack of judgment and his use of the company’s private plane were attacked.

Roshanara Ali, MP: “Greensel has used you, exploited your reputation and crushed the reputation of the prime minister’s office in the mud.”

“Your reputation is torn, Attack on Roshanara Ali, Labor MP. Greensel used you, took advantage of your reputation and crushed the reputation of the Prime Minister’s office in the mud. And I agreed to play the game, it’s very disappointing. “ MEPs were pleased to be surprised by the signature of a letter which was sent to Tom Schouler, Permanent Secretary of the United Kingdom to the Treasury: «Love, DC» (“Kiss you, DC”). So what is the relationship between the two men asked a member of Parliament? “I always sign my letters like that.”Cameron replied.

The case had not yet been made public Greensel had never seen a thunderous bankruptcy in March. Created by Lex Greensill, an Australian who has lived in the UK for two decades, the company was a factoring financial institution (this includes providing money that its clients owe to the company, to facilitate treasury). But the man claimed that he had reinvented the recipe, and was doing better thanks to new technologies. The truth, now known, is that Greensel doubled adventure loans to poor creditworthy clients, until the House of Cards collapsed.

You have 57.22% of this article to read. The rest is for subscribers only.

“Unapologetic pop culture trailblazer. Freelance troublemaker. Food guru. Alcohol fanatic. Gamer. Explorer. Thinker.”