Here’s what to expect at the congressional hearings on GameStop and Robinhood

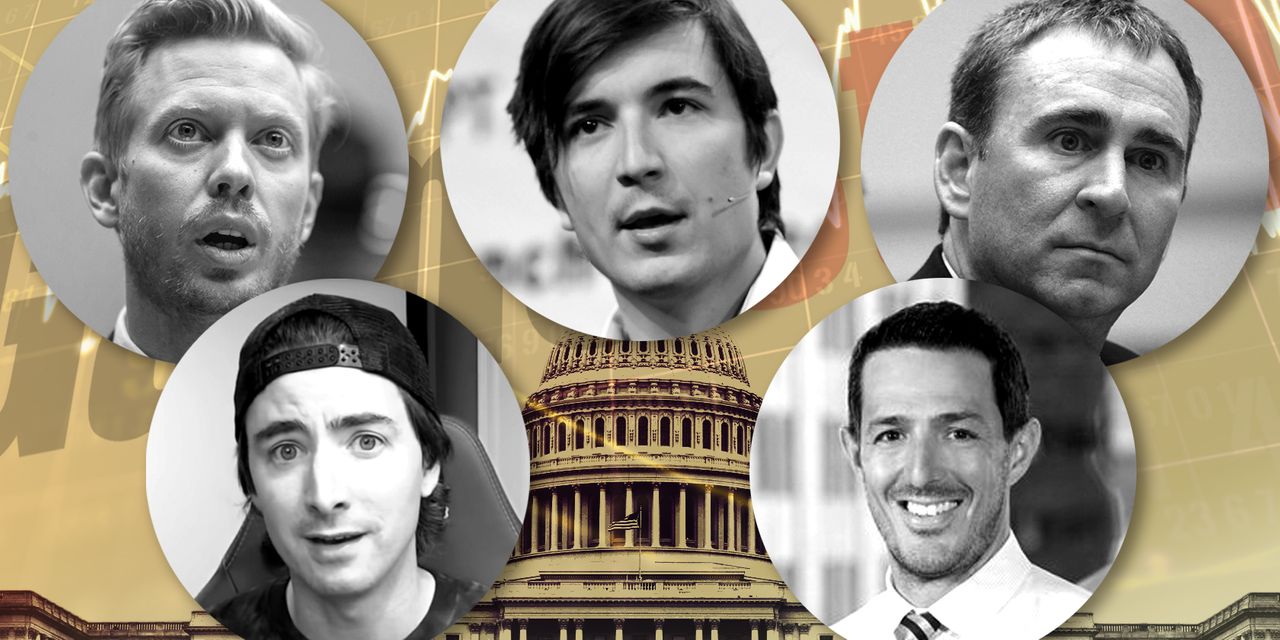

The House Financial Services Committee is set to question several major players in the GameStop saga following public outcry against internet trading platform Robinhood and decisions of other brokers to briefly restrict trading in so-called meme stocks last month.

CEOs at Robinhood, market maker Citadel Securities, hedge fund Melvin Capital, social media company Reddit, and Keith Gill, an independent investor who discovered fame and fortune through his early purchases of GameStop Inc. GME,

Stock, everyone will testify at the hearing, scheduled for it Thursday noon. Here’s what to expect:

Players

RobinhoodThe popular online broker with no commission has been the preferred tool for a new class of retail investors who are integrating social media into their investment decisions.

As the company’s app has grown in popularity in recent years, it has been criticized for it Do not be forthright With clients about how to make money and about intermittent interruptions that have left their users unable to trade. Last month’s decision to restrict purchases of GameStop Inc. , Just as the social media campaign has been to raise shares, to accusations that the company was trying to sabotage the stock to help short sellers.

However, Robinhood executives said in testimony under oath that Robinhood has halted stock buying because its users were overwhelmingly placing long one-way bets on highly volatile stocks, often with borrowed money, prompting massive calls for collateral from the broker’s clearinghouse. . Co-CEO Vlad Tenev will testify on Thursday.

Citadel Stock ExchangeBillionaire Ken Griffin, who will testify on Thursday, is founded by a stock wholesaler who is one of Robinhood’s biggest sources of income, paying middlemen for the privilege of executing their clients’ orders. Market makers like Citadel Securities practice this “pay-off order flow” because they earn very little profit from every trade they make – the difference between the buy and sell price of the securities – and this is on average slightly greater than what they pay to execute the trade.

Melvin Capital: A hedge fund is said to have incurred huge losses after betting on GameStop to short the shares. The fund was bailed out by fellow hedge funds Point72 and Citadel, According to the Wall Street Journal. The Citadel hedge fund is partly owned by Ken Griffin, but is otherwise not affiliated with Citadel Securities. CEO Gabriel Plotkin will appear before the panel on Thursday.

RedditA popular social news platform where GameStop stocks are heavily promoted. Regulators have been investigating the site to determine whether users promoting such meme stocks have engaged in any illegal behavior, such as deliberately lying about a stock in order to manipulate its price. Reddit CEO and co-founder Steve Huffman will testify on Thursday.

Keith Gill: An independent investor who has posted a lot about his success investing in GameStop and other meme stocks.

What questions will be asked?

Lawmakers will be eager to see if there is any collusion on the part of Robinhood, Citadel Securities and Melvin Capital to stem the rally in GameStop shares. Citadel Securities and Robinhood has publicly denied that this is the case, but expects panelists to thoroughly investigate the matter.

Ben Colton, director of research at Beacon Policy Advisors, speculated that there could be a very wide range of cases raised at the hearing outside of the investigation as Robinhood prompted to restrict trading.

“What I’m looking for is whether the narrative emerges from hearings that provide a pathway forward for organizational or legislative changes, or whether members are more interested in sticking to their political talking points that they can compile in a press release,” he told MarketWatch.

Koulton said it was likely the latter, given that after several weeks of meme volatility subsiding, a coherent account of what the episode is telling policymakers about the state of financial markets has yet to emerge.

Democrats have done in the past Robinhood criticized features that encourage frequent use of the app, which observers have described as manipulative, but after the GameStop flip-flop, the leading Democrats have been more keen to attack hedge funds, short sell, and Robinhood for blocking new GameStop purchases than they have been criticizing online brokers because they’ve made It is very easy and attractive to speculate in a stock.

On the other hand, Republicans may see wisdom in attacking Wall Street and Silicon Valley abstractly, but Colton predicted that they would often work to counter Democrats’ attacks and calls for tighter regulation of the market structure or practices such as short selling.

“There has been a more populist tendency for the Republican Party lately,” he said, “but I doubt they would be enthusiastic about going after a huge Republican donor like Ken Griffin.”

What will be the effect of the hearing?

Without a bipartisan agreement on the issues the GameStop saga has exposed in the US financial markets, the hearings are unlikely to be anything more than the political theater, according to Brian Gardner, Stifel’s chief Washington policy strategist.

“The hearing will work on good TV, but as to whether any policy changes might arise from the GameStop episode, we will pay more attention to the Senate Banking Committee hearing on Gary Gensler’s nomination to run the SEC, given that the Securities Commission Finance and exchanges will take the lead in making any policy changes, “he wrote in a note Tuesday to clients.

He added, “Congress may shift the SEC to specific changes, but the regulatory action, not the legislation, is the likely path forward,” indicating that the Gensler session could be scheduled as soon as next week.

The most likely issue that the SEC should focus on in its regulatory review is the practice of pushing the order flow. Which critics say creates a conflict of interest Between broker’s clients and market makers, brokers accept payments from.

However, regulators have conducted extensive reviews of this practice in the past, particularly after a 2014 Senate investigation. “Lawsuits have been filed over payment for an influx of orders in the past and the SEC decided not to make any major changes,” Colton said. However, supporters of this practice say it enabled brokers to eliminate commissions, which would benefit the average investor. “Citadel and paying for the influx of requests have too many strong advocates within DC’s atmosphere that they cannot be changed.”

Senator Sherrod Brown, a Democrat from Ohio and chair of the Senate Banking Committee, said he also intends to hold a hearing “on the current state of the stock market,” but has not set a date yet.

“Organizer. Social media geek. General communicator. Bacon scholar. Proud pop culture trailblazer.”