Mining stocks are higher in a struggling UK market – and it’s another tailwind

It was an impressive 12 months for the world’s leading miners.

FTSE 350 Mining Index 156 995,

– which includes the diversified mining giants Rio Tinto Rio,

BHP BHP group,

Anglo American AAL,

And Glencore Glen,

It returned 46% to shareholders over the past year, according to FactSet, compared to a 7% drop for the broader FTSE 350 Index.

The sector benefits from the high value of the minerals they extract. Copper in the front month HG00,

Futures have jumped 62% over the past 12 months, silver SI00,

Gained 51%, Platinum PL00,

He added 32%.

There are two major trends that should boost the sector further.

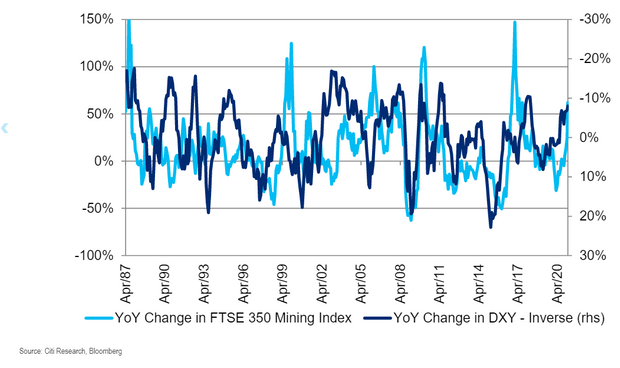

The first is the depreciation of the DXY dollar,

The weak dollar environment is leading to an increase in the purchasing power of major commodity-consuming markets, particularly China, notes Ephrem Ravi, an analyst at Citigroup. A lower dollar also helps ease global monetary conditions, as much of the world’s corporate debt is denominated in dollars.

As the chart shows, there is usually a strong correlation between mining stocks and the change in the dollar.

Another boost comes from copper’s rally against gold. Citi’s Ravi says the copper to gold ratio has been on the rise over the past year, indicating optimism about global growth. Copper is essential for manufacturing and construction, while gold is often used as a safe haven under conditions of financial duress.

Jeffrey Gondlach, CEO of DoubleLine Capital and the so-called bond king, said the copper-to-gold ratio closely tracks US government bond yields, which tend to rise as the economy improves.

According to Ned Davis Research, citing data dating back to 1995, the European mineral and mining industry outperformed the market with an average annual gain of 9.7% when the economic outlook improves, but was less than 7.4% per year when the economic outlook worsened.

Mark Phillips, European equity analyst at Ned Davis Research says it only makes sense for miners to go through booms and busts. Prosperity will begin when an increase in demand for commodities causes prices to rise while short-term supply remains relatively flat. “As prices continue to rise, this spurs companies to invest in new projects that were previously uneconomical,” says Phillips.

“However, long lead times usually mean that many companies are investing in new projects at the same time, which leads to cost pressures and an abundance of supply, which may come at a time when demand begins to decline. This leads to lower prices, and stoppage of mineral and mining companies. In which the cost curve rises from work. “

Superhero talking

Behind the gains are also recent commodity super cycles. This basically means a cycle that lasts decades, moving the commodity as a whole. “The commitment of many countries to be carbon neutral and less energy-intensive by 2050 to 2060 requires significant investment in infrastructure which will be commodity intensive. Structural models of commodity prices have shown that at every major stage of economic development: agricultural, industrial, and service, they can Commodity use changes, increasing the likelihood of a super cycle in the early stages of development, “says Daniel Gerrit, chief investment officer at Stategy Capital, which launched a global macro fund last month.

The market talk of inflation, fueled by lax monetary policy and strong fiscal spending. Analysts at Variant Perception, a research firm, assert that the increased risk of inflation, the need to hedge against it, and “cheap for generations” will lead to a commodity super cycle. Among the major banks, JPMorgan also supported the super commodity cycle view.

She is single-mindedly betting on miners for now. There are no sales deals against major miners and they are large enough to report, according to the daily updates from the Financial Conduct Authority.

But there are a few dissenting opinions. Ben Davis, an analyst at Liberum Capital, has a selling rating on Rio Tinto, and BHP. He concedes that a weaker dollar could help the rally continue, “but the price seems to have a lot of that.” Davis does not believe that commodities are in a super cycle.

But Davis expects a Chinese credit slowdown, which will soon have an impact. Loan growth gradually slowed from 13.2% year over year in June to 12.7% in January.

Demand for goods will begin to feel diminishing in Chinese credit, and while restocking in the rest of the world is a very strong force, it is unlikely to continue beyond the middle of the year. The first and biggest beneficiary of this cycle has been iron ore, which is why BHP and Rio Tinto both have the downside in the near term in our opinion.

“Organizer. Social media geek. General communicator. Bacon scholar. Proud pop culture trailblazer.”