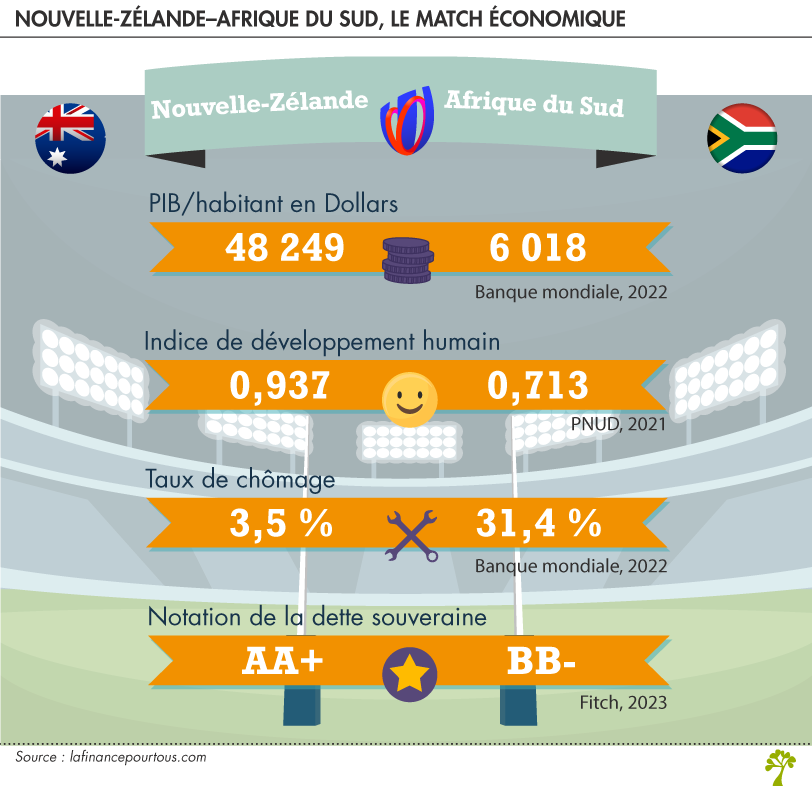

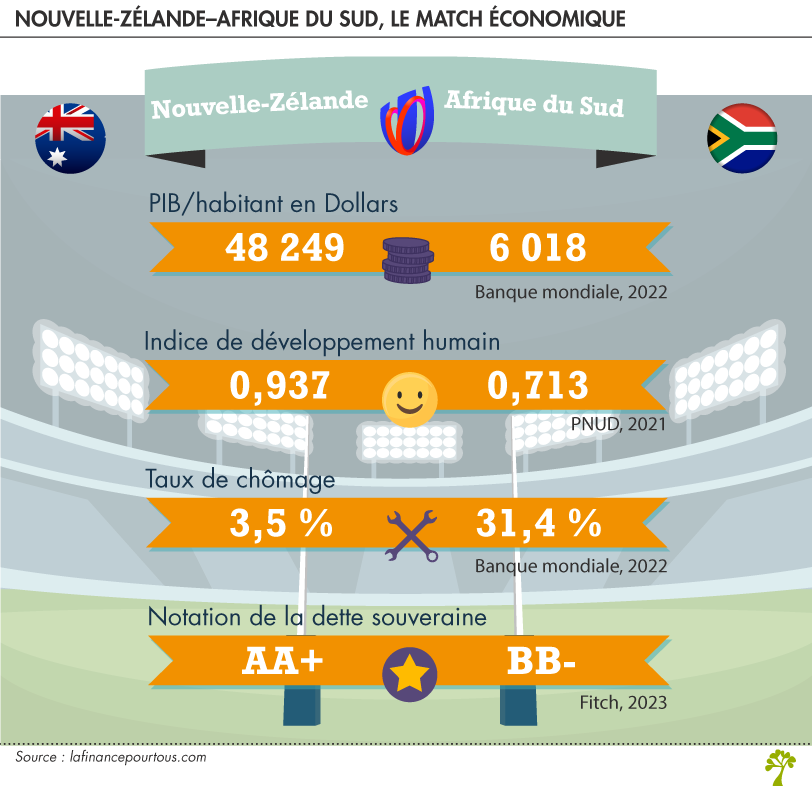

Rugby World Cup Final 2023: The economic match between New Zealand and South Africa

New Zealand and South Africa face each other on Saturday in the 2023 Rugby World Cup final. While the outcome of this sporting encounter is uncertain, the comparison between the two countries' economies clearly shifts in New Zealand's favor.

The winners of the semi-finals between Argentina and England, New Zealand and South Africa, meet on Saturday in the 2023 Rugby World Cup final. The All Blacks are slight favourites by bookmakers, while AI modelling has predicted South Africa have a 20.5% chance of winning the competition, compared to 20.2% for Zealand.

Rugby World Cup Final 2023: New Zealand v South Africa

Economically, the comparison between the two countries clearly favours New Zealand.

The latter displays first. gross domestic product Among the highest in the world: $48,249 per capita. That's eight times the GDP per capita of South Africa.

In terms of human development, New Zealand far outperforms its one-night stand rival: to'D indexHuman Development Index (HDI)According to the United Nations Development Program, it was 0.937 compared to 0.713 for its competitor. South Africa, in particular, suffers from a low life expectancy at birth (62.3 years) due to the spread of tuberculosis and HIV.

The New Zealand economy is also performing better when looking at the New Zealand economy. Chu levelpondOn the one hand, and Sovereign Debt RatingOn the other hand, with an unemployment rate of 3.5%, New Zealand is at full employment, while South Africa is suffering from massive unemployment. The unemployment rate there is 31.4%. According to data compiled by the World Bank, only the West Bank and Djibouti will have higher unemployment rates in 2022, at 42% and 37.9% respectively.

Moreover, New Zealand's sovereign debt rating is much higher than South Africa's. Fitch, one of the three major rating agencies, rates New Zealand's debt as “high quality” with a rating of AA+, while those issued by South Africa are considered “speculative investment grade” with a rating of BB-.