The Treasury had a cow, mortgage rates soared, and the Innovative Kids of Wall Street called for help, but the Fed smiled when it was created.

Junk bonds are still on la-la-land as investors are chasing yield – the risks are damned.

by Wolf Richter about Wolf Street.

The bond market settled lower on Friday. And that was a good thing for young Wall Street children who were starting to freak out on Thursday, when Treasury yields rose for 10 years, after rising for months, and accelerating over the past two weeks, to 1.52%, after having tripled since August.

By Thursday, all sorts of complex leveraged trades were starting to unravel, and forced selling began. By historical standards, and given inflation pressures now underway, those returns as of Thursday were still surprisingly low. But Wall Street definitely had a cow.

On Friday, the 10-year Treasury yield fell by 8 basis points, part of Thursday’s 14-basis-point rally, and closed at 1.44%, still higher than a year ago on February 21, 2020.

Yields are rising due to falling bond prices, creating a world of damage – mirrored in bond funds focused on long-term Treasuries, such as the iShares 20 Plus Year Treasury Bond ETF [TLT]; Its price is down about 16% from early August, after a 3.3% retracement on Friday.

The Federal Reserve agrees.

Fed governors spoke with one voice of rising Treasury yields: It’s a good sign, a sign of rising inflation expectations and a sign of economic growth. This is the slogan they kept repeating.

Fed Chairman Jerome Powell described the rise in Treasury yields as a “confidence statement”.

“This increase is likely to reflect growing optimism in the strength of the recovery and can be seen as an encouraging sign of increased growth prospects,” Kansas City Bank President Esther George said on Thursday.

St. Louis Fed Chairman James Bullard, one of the most enthusiastic doves, said Thursday: “With improved growth prospects and higher inflation expectations, a consistent rise in 10-year Treasury yields is appropriate.” Investors are calling for higher returns to offset higher inflation expectations “It would be a welcome development”.

They’re all singing from the same page: They are pessimists about QE and low rates. But they will allow long-term rates to soar, which is starting to dent some ridiculous frothes in the financial and housing markets.

These comments by the Fed on Thursday morning in support of higher long-term yields – when markets have been calling for the opposite, more quantitative easing but focused on long-term maturities to lower long-term yields – may also help worry Wall Street.

On Friday, however, the mini-panic settled again, which is a good thing because a real panic could change the Fed’s stance.

Friday’s 30-year yield fell 16 basis points, to 2.17%, erasing the jump in the previous three days. It’s now where it was on January 23 of last year:

The yield curve as measured by the difference between the 2-year return and the 10-year return was steep, with the 2-year yield remaining in place, and the 10-year yield increasing. On Friday, the difference between the two narrowed to 1.30 percentage points, from 1.35 percentage points on Thursday, and it remains the steepest yield curve by this measure since December 2016.

In August 2019, the yield curve flipped on this measure for a short period when the 10-year yield fell below the two-year return, turning the spread to negative. The yield curve has since increased in a very stiff way:

Mortgage rates are finally starting to follow.

The average 30-year fixed mortgage rate rose to 2.97% during the week ending Wednesday, Freddie Mac reported on Thursday. This does not include after the moves on Thursday and Friday.

A 30-year mortgage rate typically tracks a 10-year yield closely. But in 2020, they broke up. When the 10-year yield began to rise in August, the mortgage market ignored it, and mortgage rates continued to drop from a record low to a record low until early January, sending the housing market into a state of super frothy.

But then in early January, mortgage rates began to rise and are now up 32 basis points in less than two months – although they are still historically low.

Note the disconnect in 2020 between the weekly 10-year Treasury yield (red) and the Freddy Mac weekly measure of the average 30-year fixed mortgage rate (blue):

In this incredibly bubbley and overpriced residential market, high mortgage rates will eventually lead to some second thoughts.

And that also seemed to smile upon the Fed’s approval. They are not blind. They see what’s going on in the housing market – what are the risks that accumulate with this type of home price inflation. They can’t say it out loud. But they can allow long-term returns to rise.

Mortgage rates have some catching up. The difference between the average 30-year fixed mortgage rate and a 10-year return has been steadily shrinking since the March frenzy, and at 1.37 percentage points, it is the narrowest since April 2011.

The spread always goes from its lowest highs, like this one, towards the average. It can do this in two ways, through mortgage rates rising faster than Treasury returns, or by lowering mortgage rates more slowly than Treasury returns.

Quality corporate bonds are starting to feel the pain.

Yields have increased and prices have fallen across the investment grade range of corporate bonds, although yields remain very low by historical metrics:

AA-rated bonds averaged 1.81%, according to the ICE BofA AA US Corporate Index, up from the record low of 1.33% in early August (my cheat sheet for Corporate bond ratings).

BBB-rated bonds – just above junk – have exited from their dormancy over the past two months, with the average yield climbing to 2.39%, according to US corporate index ICE BofA BBB, up from a record low of 2.06% at the end of December. They, like mortgage rates, continued to decline into 2020, despite higher Treasury yields.

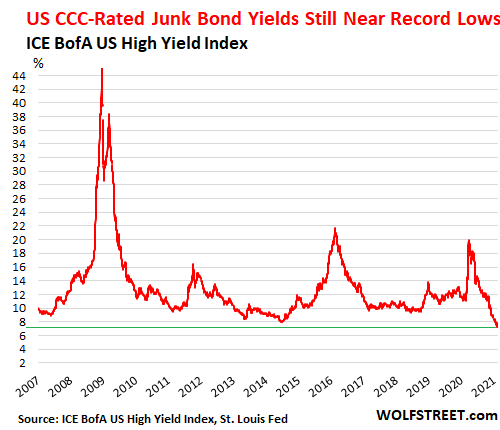

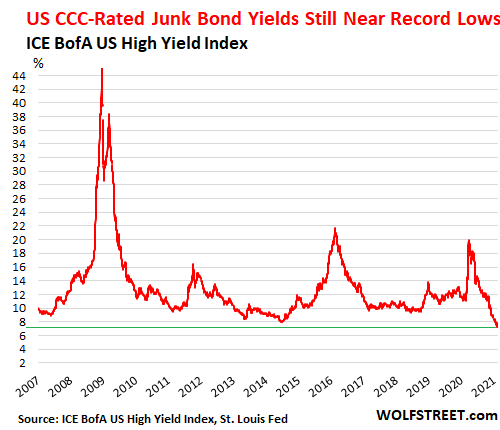

Junk bonds are still in la-la-land, with yields close to all-time lows.

BB-rated bonds – the highest of junk bonds – have exited from their dormancy over the past two weeks, and the average yield has risen to 3.45%, according to the ICE BofA AA US corporate index, up from a record low in its middle. February 3.20%.

The average yield on CCC-rated bonds – at the riskier end of the junk spectrum with a high chance of default – has barely risen from its record low in mid-February (7.17%) and now hovers at 7.27%. In March, the yield increased by as much as 20%. During the financial crisis, it jumped to the North by 40%.

The Federal Reserve smiles as it is created.

The fact that risky bonds are still yielding near record lows is a comforting sign for the Fed. This means that the financial conditions are still very easy. All kinds of high-risk companies with crushed revenues and heavy losses – think cruise lines whose revenues and losses don’t come close to wazo – can finance their cash burn by issuing large amounts of new bonds to enthusiastic investors who are chasing after returns, no problem.

So far this year, companies have issued $ 84 billion in junk bonds. Depending For Bloomberg. At this pace, the first quarter will be the largest ever unwanted bond issue. There is huge demand for junk bonds due to their high yields – the risks are damned. The chase for yields is running at full power. The overall junk bond market has swelled to more than $ 1.6 trillion.

For the Fed, this is one of many signs that the credit markets are still filled with butter, even if Treasury yields rise from record lows to levels that are still historically low. While it pledged to continue quantitative easing and not raise interest rates “for a while,” it is also telling markets in a unified voice that higher long-term Treasury yields are a sign that the Fed’s monetary policies are working as intended. These higher long-term returns remove some of the froth from the markets, including ultimately the housing market – and I don’t think that is an unintended side effect.

From crisis to crisis, even when there is no crisis. Read… Quantitative Easing from the Fed: Assets total $ 7.6 trillion. However, long-term Treasury yields rose, Wall Street kids demanding more quantitative easing

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally understand why – but want to support the site? You can donate. I appreciate it very much. Click on a beer mug and iced tea to see how:

Would you like to be notified via email when WOLF STREET publishes a new article? Register here.

“Organizer. Social media geek. General communicator. Bacon scholar. Proud pop culture trailblazer.”